Welcome To Our Mortgage Educational Blog About:

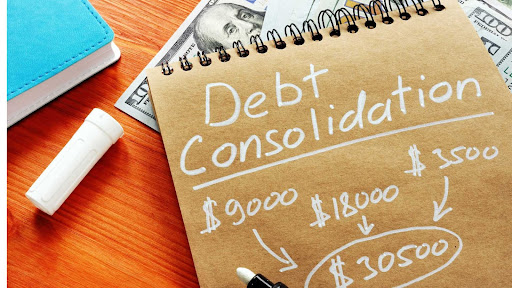

How Debt Consolidation Works In Canada? – Chaos To Control!

Feeling overwhelmed by debt? Tired of juggling multiple payments and high-interest rates?

Debt consolidation might be the solution you’ve been looking for!

Debt consolidation is a popular financial solution for Canadians struggling with multiple credit card balances, loans, and other forms of debt.

It can help simplify your finances, lower your monthly payments, and ultimately get out of debt faster.

So, learn how debt consolidation works, take control of your finances today, and say goodbye to debt stress forever!

Understanding The Basics Of Debt Consolidation

Debt consolidation is the process of taking out a new loan to pay off multiple existing debts.

This new loan, often referred to as a consolidation loan, combines all of your outstanding debt into one manageable payment.

The common types of debt consolidation in Canada include –

- Balance Transfer Credit Card

- Personal Loan

- Home Equity Loan

- Debt Management Program

- Credit Counseling

It’s important to consider the pros and cons of each option before making a decision on the best type of debt consolidation for you.

How Does Debt Consolidation Work In Canada?

1. Assessing Your Debt

This step involves gathering all of your outstanding debts, including credit card balances, personal loans, student loans, and lines of credit.

For example,

Let’s say you have a credit card balance of $5,000 with an interest rate of 20%, a personal loan of $10,000 with an interest rate of 15%, and a line of credit of $7,500 with an interest rate of 18%.

With this information, you can determine that you have a total debt of $22,500 and that the total minimum monthly payment for these debts is $500.

2. Seeking Professional Advice

Consulting with a financial advisor or credit counselor can be helpful in determining if debt consolidation is the best option for your financial situation.

They can also help you understand the pros and cons of different consolidation options, and provide you with a personalized debt repayment plan.

For example,

A financial advisor may suggest that consolidating your debt with a personal loan with a lower interest rate of 10% will lower your monthly payments to $400, and save you $100 per month.

3. Choosing A Consolidation Option

There are several types of loans and lines of credit that can be used for debt consolidation.

Some of the most common options include –

Personal Loans

These are unsecured loans that can be used for debt consolidation.

They typically have a fixed interest rate, and you will be required to make fixed monthly payments until the loan is fully repaid.

For example,

you can get a personal loan of $22,500 with an interest rate of 10% and a repayment period of 36 months.

Secured Lines Of Credit

These are lines of credit that are secured by collateral, such as a home or vehicle.

They typically have lower interest rates than unsecured lines of credit, and you will be required to make variable monthly payments based on the outstanding balance.

For example,

you can get a secured line of credit of $22,500 with an interest rate of 8% and a repayment period of 60 months.

Balance Transfer Credit Cards

These are credit cards that allow you to transfer multiple credit card balances to a single card with a lesser rate of interest.

They often have a promotional period with 0% interest, but a higher interest rate after the promotion period.

For example,

you can transfer your credit card balance of $5,000 to a balance transfer credit card with a 0% interest rate for 12 months.

4. Applying For A Loan Or Line Of Credit

This may include proof of income, employment, and credit score. The lender will then review your application and determine your eligibility for the loan or line of credit.

5. Getting Approved

After you’ve submitted your application, the lender will review it and decide if you qualify for a debt consolidation loan.

If you’re approved, the lender will provide you with a consolidation loan to pay off all of your existing debts.

Once your application is approved, the lender will provide you with the funds to pay off your outstanding debts.

6. Using The Funds To Pay Off Your Outstanding Debts

Once you receive the funds, you will use them to pay off debts as outlined in your consolidation plan.

For instance,

you can use the loan funds to pay off your credit card debt balance of $5,000, personal loan of $10,000, and line of credit of $7,500.

7. Making Your Monthly Payments

Instead of making multiple monthly payments of $500 to different creditors, you will now make one monthly payment of $680 to your lender for 36 months.

It is important to make your payments on time and in full to avoid late fees and additional interest charges.

8. Monitor Your Credit Report

Debt consolation can positively impact your credit score, but it’s important to monitor your credit report to ensure that the consolidation process is being reported correctly.

Things To Consider When It Comes To Debt Consolidation

It’s important to note that consolidating your debt will not erase it, you will still be responsible for repaying your debt, but it may make it more manageable by lowering your interest rate, extending the loan term, or reducing your monthly payments.

For example, consolidating your overall debt with a personal loan at a lower interest rate of 10% will lower your monthly payments to $680, and save you $20 per month.

It’s also essential to avoid taking on new debt after consolidating and make a budget and stick to it to maintain your financial stability.

It’s also essential to avoid taking on new debt after consolidating and make a budget and stick to it to maintain your financial stability.

Benefits Of Debt Consolidation In Canada

There are several benefits to consolidating your debt in Canada –

- Lower monthly payments

- Lower interest rate

- Simplified finances

- Improved credit score

- Reduced stress

Debt consolidation can help reduce this stress by simplifying your finances and making it easier to pay down your debt.

Ready To Apply For A Debt Consolidation Loan?

- Gather all your debts and credit card bills together and make a list of the balance, interest rate, and minimum payment for each one.

- Compare interest rates and fees from different consolidation loan providers.

- Choose the best option for you and apply for the loan.

- Once you’ve been approved, use the loan to pay off all your existing debts.

- Start making your consolidation loan payments on time.

- Stick to a budget and avoid taking on new debt to ensure you can pay off the consolidation loan as quickly as possible.

However, it is important to keep in mind that debt consolidation does not eliminate debt, it simply reorganizes it.

Therefore, it is crucial to also address the underlying reasons for the debt, such as overspending or lack of budgeting, in order to prevent it from accumulating again.

Before considering debt consolidation, it is a good idea to speak with a financial advisor to determine if it is the best option for your unique situation. Contact us today to see how we can help you.

The Bottom Line

Remember to reach out for more information and guidance. With the right approach, you can make your mortgage work for you and take control of your finances.

Are you ready to refinance your home? Reach out to me directly or start your application here: www.sandraforscutt.ca/mortgage-application/

Don’t hesitate to contact us with any questions you may have.

Recent Educational Blogs

First Responder Mortgage Program

Jan 2026 | First Responder Mortgage ProgramAt Metro Mortgage Group, we have deep respect for the everyday heroes of our city — the members of the Edmonton Police Service, EMS, and Fire Rescue Services. Your commitment keeps our community safe, often at great personal...

Pros and Cons of a Home Equity Line of Credit (HELOC)

Dec 2025 | Pros and Cons of a Home Equity Line of Credit (HELOC)If you’re a Canadian homeowner, you’ve probably heard friends or family talk about using a home equity line of credit, or HELOC. People often use it to renovate, consolidate debt, or help kids with school...

What the Latest Bank of Canada Rate Cut Means for Canadian Borrowers and Homeowners

Nov 2025 | What Rate Cut Means for Canadian Borrowers and Homeowners On October 29, 2025, the Bank of Canada made headlines by cutting its benchmark policy rate by 25 basis points. This move brought the policy rate down to 2.25%. For Canadians with mortgages, loans,...